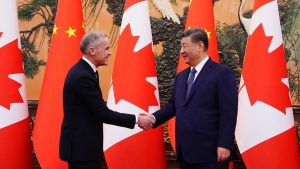

Canada-China Trade Deal 2026: Electric Vehicle Tariffs and Canola Exports Transform Bilateral Trade Relations.

In a historic trade agreement that reshapes North American and Asian economic partnerships, Canada and China have announced groundbreaking tariff reductions on electric vehicles and agricultural products.

This January 16, 2026 bilateral trade deal marks the most significant Canada-China trade relations development since 2017, with major implications for global trade policy, EV market dynamics, and agricultural exports.

Breaking News: Canada Slashes Chinese EV Tariffs in Major Policy Shift.

Prime Minister Mark Carney’s official state visit to Beijing the first Canadian PM China visit in nearly a decade has delivered transformative results for international trade and electric vehicle industry stakeholders.

Electric Vehicle Tariff Reduction: What You Need to Know

The Canada EV tariff policy overhaul includes critical changes:

Chinese electric vehicles Canada import quota: 49,000 units annually.

Canada EV tariff 2026: Reduced from 100% to 6.1% on qualifying imports.

Chinese EV investment Canada: Potential billions in automotive manufacturing infrastructure.

Canada electric vehicle market: Expected expansion with increased consumer choice.

Green technology trade: Alignment with Canada climate goals and net zero emissions targets.

Prime Minister Carney emphasized that this Canada-China economic cooperation will strengthen Canadian EV manufacturing, create clean energy jobs, and position Canada competitively in the global electric vehicle supply chain.

Ontario Premier Doug Ford raised concerns about Chinese EV market dominance and Canadian auto industry protection, calling for stronger domestic manufacturing guarantees.

Canadian Agriculture Exports Get Major Boost:

Canola Trade Deal Details

Canadian farmers and agricultural exporters are celebrating unprecedented market access restoration in this comprehensive trade agreement.

Canola Tariff Reduction: Timeline and Economic Impact.

The agricultural trade provisions deliver substantial benefits:

Canada canola exports to China: Tariffs dropping from 84% to 15% by March 1, 2026.

Canadian canola market access: Nearly $3 billion in restored export opportunities.

Canada seafood exports: Lobster, crab, and shellfish gaining renewed Chinese market entry.

Canadian pulse crops exports: Trade barriers removed for peas and lentils.

Canada agricultural trade 2026: Recovery from $2.6 billion in 2025 retaliatory tariffs.

This Canada-China agricultural agreement represents one of the largest canola trade deals in Canadian history, providing critical relief for prairie farmers and maritime fishing communities.

Strategic Energy Partnership: LNG Exports and Renewable Energy Cooperation.

Beyond immediate tariff relief, this bilateral agreement establishes frameworks for long term Canada-China energy cooperation.

Canadian Energy Exports: Oil, Gas, and Clean Technology.

Key energy sector initiatives include:

Canada LNG exports to Asia: Target of 50 million tonnes annually by 2030

Canadian natural gas China market: Expanded access for liquefied natural gas producers.

Canada renewable energy investment: Joint offshore wind energy projects.

Canadian electricity grid expansion: Plan to double capacity within 15 years.

Canada-China green energy partnership: Collaboration on clean technology innovation.

These energy trade provisions position Canada as a major Asia-Pacific energy supplier while advancing renewable energy infrastructure development.

High-Level Economic Dialogue Restoration

Both nations committed to reinstating Canada-China economic dialogue mechanisms suspended during recent trade tensions, creating formal channels for:

Bilateral trade dispute resolution.

Investment opportunity identification.

Technology transfer negotiations.

Strategic sector cooperation planning.

Geopolitical Implications: Canada-China-US Trade Triangle

International trade experts view this agreement as Canada pursuing independent China trade policy while maintaining US-Canada alliance commitments.

Canada Balancing US and China Relations

This deal demonstrates:

Canadian foreign trade policy independence: Strategic economic decisions based on national interests.

North American trade dynamics: Canada navigating complex US-China trade war spillover.

G7 China policy divergence: Western allies pursuing varied approaches to Chinese economic engagement.

Canada diplomatic relations: Building bridges with multiple global economic powers.

Additional discussions covered Canada-China visa-free travel possibilities and Arctic cooperation, including shared perspectives on Greenland territorial issues.

Economic Impact Analysis: Winners and Strategic Considerations.

This comprehensive Canada-China trade reset 2026 creates significant opportunities across multiple sectors.

Major Benefits:

Canadian farmers income: Billions in restored agricultural commodity sales.

Canada EV technology access: Learning from Chinese electric vehicle innovation.

Foreign direct investment Canada: Chinese capital in automotive manufacturing.

Canadian energy sector growth: Expanded Asian export markets.

Canada jobs creation: Clean technology and manufacturing employment.

Key Challenges:

Canadian industry protection: Safeguarding domestic manufacturers from unfair competition.

Canada trade policy risks: Balancing Chinese investment with sovereignty concerns.

US-Canada trade relations: Managing potential American concerns about Chinese market access.

Canadian supply chain security: Ensuring technological independence.

What This Means for Canadian Businesses and Consumers.

Electric Vehicle Market Impact

Canadian EV prices: Potential consumer savings with increased import competition.

Canada electric car sales: Broader vehicle selection and market expansion.

Canadian auto dealerships: New Chinese EV brands entering market.

Canada EV charging infrastructure: Growth supporting increased adoption.

Agricultural Sector Opportunities

Canadian canola farmers: Restored profitability and market stability.

Canada food exports growth: Expanded access to 1.4 billion Chinese consumers.

Maritime fishing industry: Renewed premium seafood market access.

Western Canadian agriculture: Economic recovery for prairie provinces.

Expert Analysis: Future of Canada-China Trade Relations.

Trade policy analysts project this agreement could reshape bilateral economic engagement for years:

Canada trade diversification: Reducing dependence on single markets.

Chinese investment in Canada trends: Increased FDI flows in strategic sectors.

Canada global trade positioning: Enhanced role in Asia-Pacific commerce.

Bilateral trade volume projections: Potential return to pre-2018 levels exceeding $100 billion.

Implementation Timeline: Key Dates for Canada-China Trade Deal

Immediate (January 2026):

Agreement announcement and framework establishment.

High-level economic dialogue resumption

Short-term (March 1, 2026):

Canola tariff reduction to 15% takes effect

Initial Chinese EV imports under new quota system.

Medium-term (December 2026):

Anti-discrimination measures on canola meal expire.

First-year trade volume assessments

Long-term (2030):

Canadian LNG exports target: 50 million tonnes to Asia annually.

Electrical grid doubling completion target

Conclusion:

Historic Reset in Canada-China Economic Relations. The Canada-China trade agreement 2026 represents a watershed moment in bilateral commerce, combining immediate tariff relief with long-term strategic cooperation frameworks.

This comprehensive deal addresses critical sectors including electric vehicles, agriculture, and energy, potentially adding billions to Canadian GDP.

For Canadian businesses, farmers, and workers, this agreement unlocks substantial opportunities in the world’s second-largest economy. Success will depend on effective implementation, genuine Chinese investment commitments, and sustained diplomatic engagement.

As global trade patterns evolve and countries navigate geopolitical complexity, this pact demonstrates that pragmatic economic partnerships can advance national interests while maintaining traditional alliances.