Chinese independent oil firms extend footprint in Iraq as majors retreat

Chinese independent oil and gas companies are rapidly deepening their presence in Iraq’s oil sector.

As Western giants like ExxonMobil and Shell scale back operations, nimble players such as Geo‑Jade Petroleum, United Energy Group (UEG), Zhongman Petroleum and Anton Oilfield Services are capitalising on new profit‑sharing contracts to secure valuable assets and accelerate production growth.

The shift away from fixed‑fee agreements to profit‑sharing contracts has significantly boosted the appeal of Iraq’s licensing rounds.

These smaller Chinese companies, backed by ex‑state oil veterans, are leveraging fast project delivery, low costs, and a high tolerance for operational risk to develop infrastructure swiftly and at scale.

Among them:-

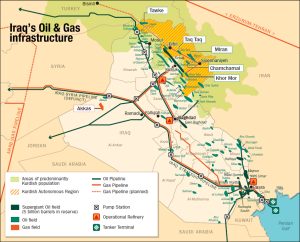

United Energy Group (UEG) leads the pack with around 120,000 barrels per day of production in Iraq’s Block 9, and has secured exploration rights for the Fao block near the Kuwaiti-Iranian border.

Zhongman Petroleum won licenses in Eastern Baghdad (North) and Middle Euphrates blocks, committing $481 million in investment, also branching into gas operations in Algeria.

Geo‑Jade Petroleum, spearheading the South Basra integrated project, has pledged $848 million toward a refinery and ramping up output at the Tuba field to 100,000 bpd, aiming to reach 40,000 bpd by mid‑2027.

Anton Oilfield Services transitioned from service provider to operator last year after securing development rights for Iraq’s Dhufriya oilfield in Wasit province.

Iraq, second-largest oil producer in OPEC, aims to boost output beyond 6 million bpd by 2029 to meet domestic needs and regional demand.

Chinese independents are poised to double their Iraqi output to 500,000 bpd by 2030, filling gaps left by major firms and accelerating Iraq’s production roadmap.

While their cost‑efficient, fast‑tracking model has injected momentum into Iraq’s energy sector, it has also raised concerns over transparency, technical standards, and a workforce heavily skewed towards Chinese nationals at the expense of local employment opportunities.

Despite criticisms, Iraq remains keen to attract both Chinese and Western investment.

Major firms such as TotalEnergies and BP are also returning with sizeable commitments to redevelop assets such as those in the Kurdish region and southern fields.

As Iraq continues to diversify its energy partnerships, the rise of independent Chinese oil firms marks a transformative shift in the Middle East’s hydrocarbon investment landscape.

Their success could influence future licensing rounds and global investment patterns in the region.

Source: Reuters and other media outlets